bexar county tax assessor payment

In order to be timely payment mailing or common carrier of taxes must be postmarked or receipted on or before the due date. County tax assessor-collector offices can answer questions for the taxing units they serve about.

FOR IMMEDIATE RELEASE FOR MORE INFORMATIONAPRIL 25 2022 Larry Stein 405 713-1201 cell 405 361-9307More than 2900 NEW HOMES in OK CO in 2021Lots of questions about the Oklahoma County real.

. An involuntary lien is typically placed on a property due to unpaid obligations like a tax bill or a home improvement invoice which is sometimes called a mechanics lien. Property Tax Late Charges. Other locations may be available.

For details contact the Bexar County Tax Assessor-Collectors Office. In order to be timely payment mailing or common carrier of taxes must be postmarked or receipted on or before the due date of January 31st. A tax discount may be available on the entire tax owed.

Acceptable forms of payment vary by county. Jurors parking at the garage will receive a discounted rate please bring your parking ticket for validation at Jury Services. TaxNetUSAs comprehensive database gives you full access to Collin Countys delinquent property tax list.

For questions regarding your tax statement contact the Bexar County Tax Assessor-Collectors Office at 2103356628. Wondering how the county assessor appraises your property. These are the liens that affect your ability to sell a property easilyand also are more difficult to discharge from the public record.

Zillow has 37 photos of this 379900 4 beds 3 baths 2626 Square Feet single family home located at 4601 PEBBLE RUN Schertz TX 78154 built in 2001. Contact local County Assessors Office for details Indiana. The process begins when the county tax assessor places a lien against a property for unpaid property taxes.

Exclusive Meetings for Legislators and County Officials 3 rooms. Property Tax Payment Options. Bexar County Tax Assessor-Collector Office P.

Please allow up to 15 days for the processing of your new window sticker or new plates by mail. The county will then sell that lien to the highest bidder at an auction. The 10-Month Payment Plan applies to a property the person occupies as a residential homestead with one of the following exemptions.

Albert Uresti MPA Physical Address. Kent County 1886 Tax Assessor. 211 South Flores Street San Antonio TX 78207 Phone.

There are several options available to taxpayers including Half Pay and Pre-Payment Plans. Disabled person exemption Age 65 or Over exemption. Rates will vary and will be posted upon arrival.

There are 3 land for sale in Haskell County OKOklahoma. The buyer seller or lienholder may transfer title with the appropriate documents. Other information related to paying property taxes.

Montgomery County 3690 Tax Assessor. Looking for FREE arrest records criminal charges in Texas. Prince Georges County 3216 Tax Assessor.

Call us at 817 310-1077 for delinquent data pricing today or contact us and well get back to you. The Bexar County Appraisal District BCAD sets property values and is a separate organization from the Bexar County Tax Assessor-Collectors office. For more information on property values call BCAD at 210-242-2432.

Questions about a taxing unit that is not listed as consolidated in a county should be directed to the individual taxing unit. Somerset County 1174 Tax Assessor. Please contact your county tax office or.

Lunch provided in-person only 3-430 pm. Quickly search arrest records from 554 official databases. Harford County 2582 Tax Assessor.

Meeting of County Affiliate Organizations in-person only County associations organize and host a 15-hour meeting to discuss legislative issues or association business during the conference. Box 839950 San Antonio TX 78283-3950. Jurors parking at the garage will receive a discounted rate please bring your parking ticket for validation at Jury Services.

When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. Tax Liens by the Numbers. All advertisements have been updated.

The median property tax in Indiana is 085 of a propertys assesed fair market value as property tax per year. In King County Washington property values increased 9 from 2021 to 2022. 211 South Flores Street San Antonio TX 78207 Phone.

Despite appraisers extensive education and extensive research time they can only make one decision. Therefore your property tax liability depends on where you live and the value of your property. Rates will vary and will be posted upon arrival.

First lets address growing property tax values. Legislative Reception in. However individuals must come in or mail the documents to the county tax office of the buyer seller or lienholder.

Land For SaleShowing 1 - 3 of 3 Homes. When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. Acceptable forms of payment vary by county.

Other locations may be available. Bexar County Tax Office. Indianas median income is 56350 per year so the median yearly property tax paid by Indiana residents amounts to.

This tax lien typically has first priority for payment in the hierarchy of other encumbrances that might exist against the property such as first or second mortgages. County tax assessor-collector offices provide most vehicle title and registration services including. Looking for FREE property tax records assessments payments in Texas.

If you believe your home is below the belt the bexar county tax assessor will be able to provide you with a correction. County tax assessor-collector offices provide most vehicle title and registration services including. Indiana has one of the lowest median property tax rates in the United States with only ten states collecting a lower median property tax than Indiana.

Box 839950 San Antonio TX 78283-3950 Telephone. A disabled veteran in Indiana may receive a property tax exemption of up to 24960 if the veteran served honorably during any period of wartime and is 100 percent disabled as a result from service or is at least 62 years of age with at least a 10 percent service-connected disability. Quickly search tax records from 1998 official databases.

If you have bought a vehicle from a Texas dealer and you are a Texas resident the dealership will transfer the title at the tax office. 233 N Pecos La Trinidad San Antonio TX 78207 Mailing Address. Such as participating grocery stores.

Instead its based on state and county tax levies. Howard County 4261 Tax Assessor. Again this will depend on your countys practices but its common for appraisals to occur once a year once every five years.

The Bexar County Tax Assessor-Collectors Office is the only County in the State of Texas with a 10-month payment plan. Please contact your county tax office or visit their Web site to find the. Garrett County 1173 Tax Assessor.

Queen Annes County 2347 Tax Assessor.

Property Tax Information Bexar County Tx Official Website

Payments Bexar County Tx Official Website

Showlist Bexar County Good Customer Service Acting

Bexar County Property Tax Deadline Looming Tpr

Public Service Announcement Residential Homestead Exemption

Everything You Need To Know About Bexar County Property Tax

Bexar County Residents Received Over 11 Million In Aid For Delinquent Property Taxes Mortgage Paym Youtube

Bexar County Tax Assessor Registration Services 233 N Pecos St San Antonio Tx Phone Number Yelp

Nelda Martinez On Twitter Bexar County San Antonio Tx Corpus Christi

Bexar County Budget Proposal Keeps Current Tax Rate

County Commissioners Vote To Decrease Property Tax Rate In 2022

Property Tax Information Bexar County Tx Official Website

Chief Appraiser Expects A New Record Of Appeals To Be Filed Next Week In Bexar County

Bexar County Tax Office To Stay Open But Close Lobbies What That Means For You

15 000 Homeowners In Bexar County Eligible For Help On Delinquent Property Taxes Kens5 Com

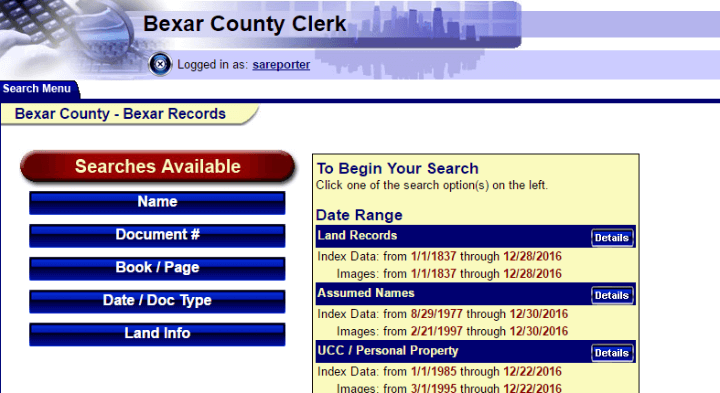

How To Research A Property S History Using Bexar County S Free Records Search John Tedesco